-

credit

How Does Credit Card Interest Work?

Happy Financial Literacy Month! This is the month of the year that you’ll probably be seeing financial topics discussed everywhere. Luckily, you’re used to that from me. However, this month, I want to write in-depth about questions that I often get from my clients. Questions that don’t always seem very straight forward, but are important to know the answers to. This week, I’m diving into credit card interest! It’s the kind of thing that is talked about as if everyone understands it, but most people really have no idea. So here are the facts that will hopefully help you manage your credit card debt a little bit better.

How Interest Rate is Decided

The interest rate (also called Annual Percentage Rate or APR) for a credit card is determined by the credit card company. Most cards will have a percentage range, such as 16.24-24.99%. Where you will fall on that range depends on your credit score and credit history. The higher your score, the lower the APR will likely be. The lower your score, the higher the APR will be. Basically, you are being penalized by the credit card company for your credit history or lack thereof. They do this because they assume that if your credit score is low, you won’t necessarily pay back your bills on time, so they want to earn more money from you via the interest rate.

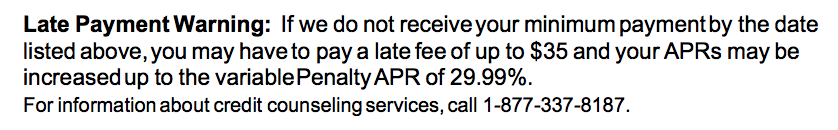

Plus, you might get punished later on, even if you started with a lower interest rate. If you miss a payment, or pay late, the credit card company reserves the right to increase your APR. I saw the warning below on one of my credit card statements. So make sure you’re paying your bills on time so that you don’t owe even more later.

Not sure what your credit score is? Get it for free at Credit Karma or Credit Sesame. Your bank might even offer the service for free too! And no, checking your score does not negatively impact it.

Note: The free credit score companies make their money from offering credit cards to you. If you know you struggle with credit card spending or debt, try not to feel pressured into applying for the cards they offer to you. Pro tip: Unsubscribe from the offer emails that they will start sending to you.

How to Find your Interest Rate

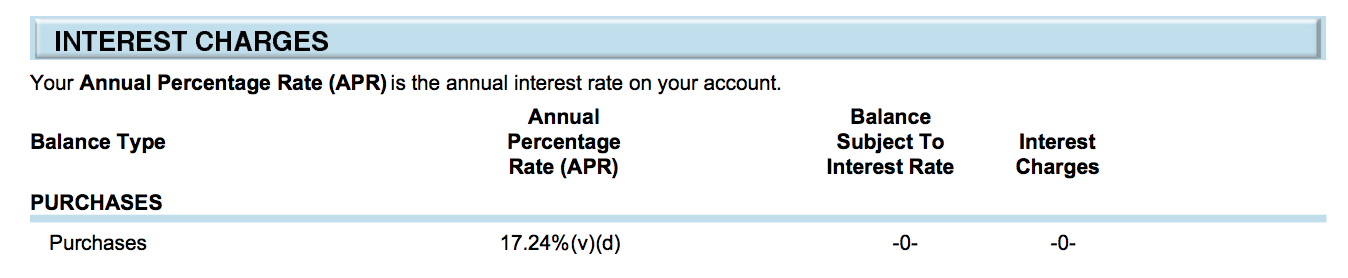

Log into your credit card account online. Find the area of the website where your past statements are stored, and pull up your most recent credit card statement. Typically, if you scroll down, past the list of transactions, you will find a section that is titled “Interest Charged” (or some variation of the same). Beneath that, the annual percentage rate (APR) on purchases and cash advances will be listed. Oftentimes, the APR on purchases and cash advances will be different, as cash advances (if they are offered by your card) will have a higher interest rate. This section will also tell you how much interest you’ve paid since the beginning of the year. That number can be pretty sobering and may motivate you to start paying down your debt more aggressively.

How the Interest Rate is Calculated

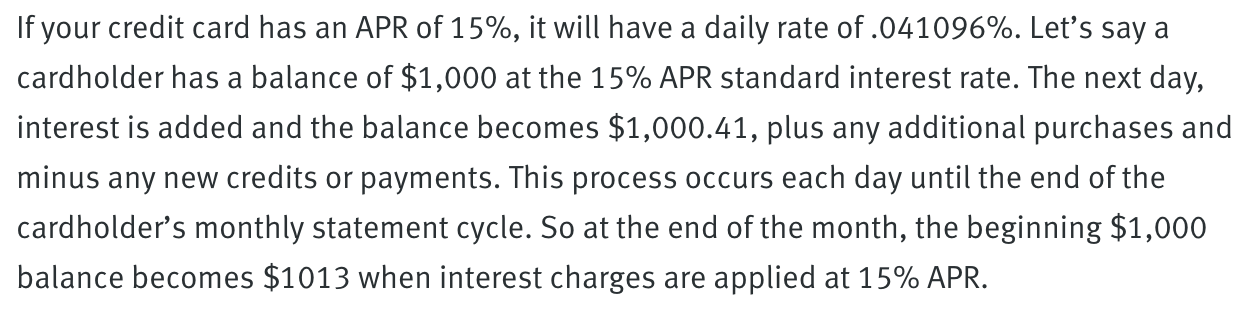

The very term “annual percentage rate” makes it sound like the interest might only be added annually, but it’s actually applied to your card on a monthly basis, when your statement closes. The actual APR number is how much interest is charged over the course of the year, but you can figure out how much your daily interest rate is, so that you can estimate how much you’ll owe over a given period of time. You would do that by dividing the APR by 365.

Here’s a great example from Discover:

As you can see, if you have a balance on your card that you’re paying interest on, you’re giving the credit card companies extra money that you didn’t spend originally. If your balances are higher than $1,000, that amount can add up to quite a lot. Eventually, interest fees can make it really difficult to pay back the original debt at all.

Why the Interest Rate Matters

Simply, your interest rate determines how much you end up paying out of pocket towards your credit card, in addition to what you initially purchased. If you carry a balance on your card over time, every month, you’ll be charged added interest based on that balance. If your interest rate is as high at 27%, that can add up very quickly. Plus, if you’re only able to pay the minimum balance, over time, the interest accumulation can make it very difficult for you to pay off your debt. And think of all the things you could do with that money if you didn’t have to spend it on interest!

How to Avoid Paying Interest

The only way to avoid paying interest on your credit card is to pay off your full balance every month. It’s that simple. If you only spend what you can afford to pay back every month, you won’t ever owe any interest fees. That is the only way that having credit cards is worthwhile in the long run. So use your credit card as if it’s a debit card and only spend what you know you have in the bank!

An alternative option is to get a credit card that offers a 0% APR for an introductory period. This period is often 12-18 months. That can be a great opportunity if you know you’ll have to make a purchase that you won’t be able to pay back right away. However, this can be a slippery slope. If you aren’t able to pay off a balance in the 0% APR period, the APR will eventually go up and you’ll start being charged interest. So only take this road if you’re certain you’ll be able to pay off your card during the introductory period.

How to Lower the Interest Rate

Have you been a good customer, paying your bills on time and never missing a payment? Your credit card company has probably noticed. So give them a call and ask them if they can lower your interest rate. This is especially helpful if you are working on paying down a balance, so you don’t pay as much in interest over time. Yes, the company may very well tell you no, but that’s the worst that can happen. It doesn’t hurt to ask!

Other resources:

-

https://www.creditkarma.com/credit-cards/i/how-does-credit-card-interest-work/

-

https://www.nerdwallet.com/blog/credit-cards/how-credit-card-interest-calculated/

Have you ever successfully had your interest rate lowered? Have you ever been shocked by the amount you were paying in interest? Share in the comments!